Top 10 Corporate Sustainability Priorities for 2025

In 2025, corporate sustainability leaders are adapting to shifting policy environments and stakeholder demands while broadening their focus to emerging priorities like biodiversity, water availability, AI, and business integration. This report outlines the top 10 sustainability priorities for the remainder of the year based on analysis of current data, executive insights, and emerging trends.

Top 10 Corporate Sustainability Priorities for 2025

10. AI: AI offers sustainability gains but raises potential environmental, social & governance (ESG) risks.

9. Sustainability storytelling: Beyond core disclosure, effective storytelling can engage diverse audiences and advance goals.

8. Business integration: The embedding of ESG into core functions is uneven but increasingly urgent.

7. Biodiversity: Nature risks are rising; disclosures are growing but measurement remains complex.

6. Water stewardship: Water stress is accelerating local risk strategies and reporting.

5. Supply chain transparency: Due diligence laws and reputational risk are driving deeper supplier scrutiny.

4. Climate strategy: Companies are deepening climate disclosure and aligning capital with risk, despite the evolving policy environment.

3. Return on investment (ROI): Internal expectations are rising to show the business case for sustainability investments.

2. ESG reporting regulations: Mandatory disclosure rules are expanding but increasingly fragmented across jurisdictions.

1. Policy shifts: US policy shifts are reshaping ESG language, legal review, and strategy.

Priority 10: AI

Companies recognize both opportunities and risks in leveraging AI for sustainability purposes

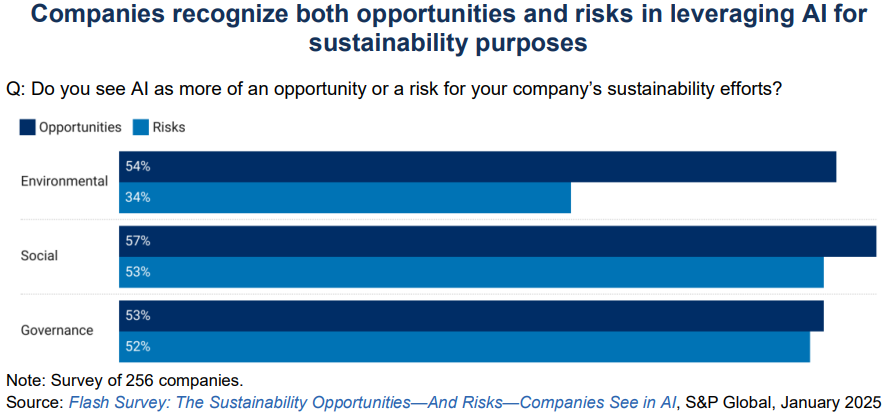

As AI becomes more embedded in how companies operate and create value, it is also emerging as a key sustainability issue—both as a tool to advance ESG goals and as a source of ESG risk.

One of the most immediate applications is in sustainability reporting. Generative AI can streamline disclosure drafting by synthesizing large data sets, aligning language with reporting frameworks, and producing tailored content for different audiences. While most sustainability teams are still in the early stages of AI adoption, the technology also offers more advanced applications that can help drive core goals and initiatives—such as forecasting climate risks, optimizing energy use and emissions reduction strategies, and identifying supply chain vulnerabilities.

At the same time, AI poses significant sustainability and governance challenges. Training and operating large models can require considerable energy and water resources, heightening environmental concerns—especially in areas with limited resources. Ethical and social risks such as biased training data, opaque decision-making, and uneven impacts on vulnerable populations further complicate responsible deployment. As AI adoption accelerates, sustainability and ESG teams can help align corporate AI practices with environmental objectives, social responsibility, and emerging regulatory expectations.

Priority 9: Sustainability Storytelling

Many firms are experimenting with creative approaches to sustainability storytelling, going beyond traditional data-heavy reporting

Telling a credible, engaging story to stakeholders remains a priority for sustainability leaders. While regulatory and investor expectations are driving more consistent and robust ESG disclosures, many companies also recognize the strategic value of storytelling. A compelling narrative can do more than report progress: it can help advance initiatives, reinforce business priorities, and engage a broader range of stakeholders. When done well, it can help embed sustainability more deeply into the business, differentiate the brand, and reach new audience segments.

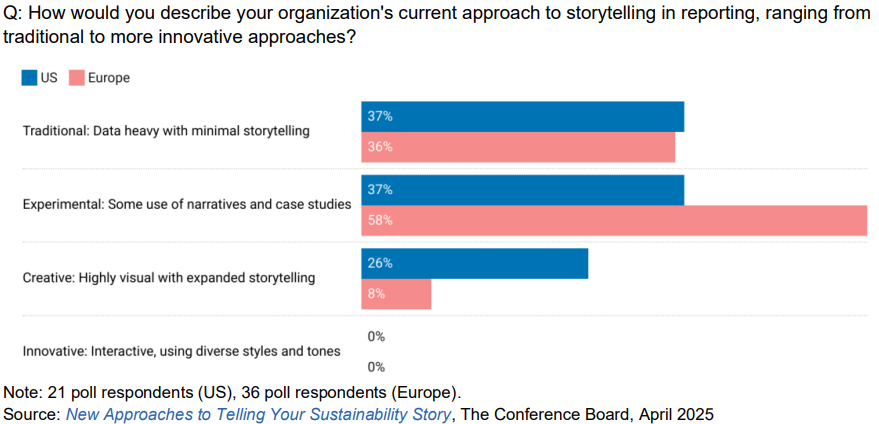

Still, many companies remain in the early stages of evolving their sustainability communications. A recent poll of sustainability leaders found that over one-third of US and European firms still rely on traditional, data-heavy reports with limited storytelling, though many are beginning to explore more creative and interactive formats. Progress often begins with audit-quality data, brought to life through real-world examples—highlighting employees, communities, and partners—to make sustainability efforts more tangible and relatable. Messaging can also be tailored: investors and regulators prioritize materiality and measurable results, while employees and customers respond more to purpose, impact, and authenticity.

Priority 8: Business Integration

Sustainability integration is uneven across many firms, with the most progress seen in legal, procurement, operations, and communications

Integrating sustainability into core business functions has become a more immediate priority for corporate leaders in 2025, a trend driven by evolving regulations, heightened investor scrutiny, and internal pressure to show tangible progress. As reporting matures, the focus is shifting toward embedding ESG into real business decisions—especially in supply chain strategy, enterprise risk management, product development, and capital planning. This shift raises key questions about how to best position, structure, and empower sustainability teams to embed ESG considerations and culture across the organization.

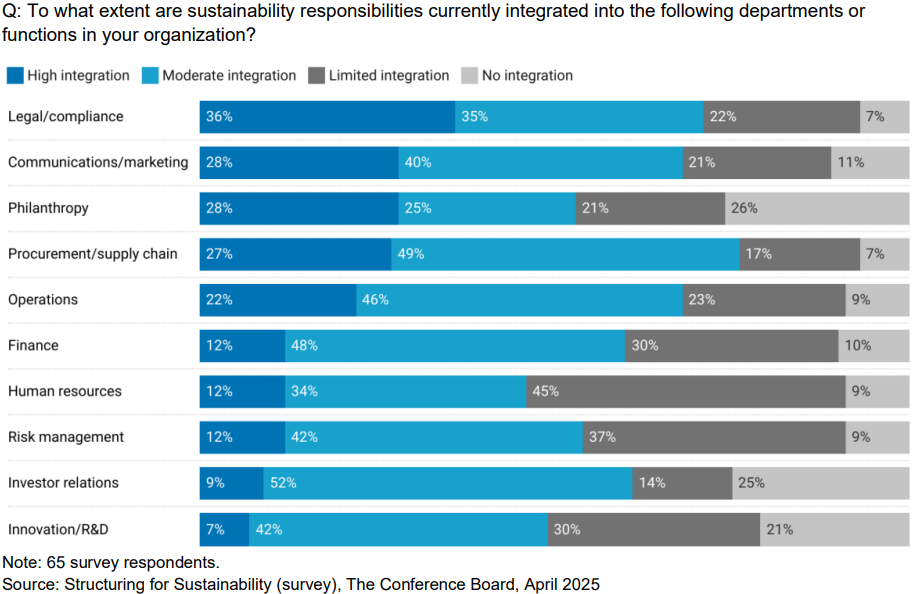

In practice, many companies are adopting a hybrid “hub-and-spoke” model. A central, often small, sustainability team sets strategy, manages reporting, and leads external engagement, while business units and functions take on execution. Legal, procurement, finance, and human resources (HR) subject-matter experts lead on relevant priorities, enabling scale through centralized coordination and local accountability. Results from a recent survey from The Conference Board show integration is most advanced in legal, procurement, operations, and communications; but remains limited in finance, HR, investor relations, and research and development—with the latter group of functions critical to aligning capital, workforce, and innovation with long-term sustainability goals.

Priority 7: Biodiversity

Most S&P 500 companies have adopted biodiversity policies

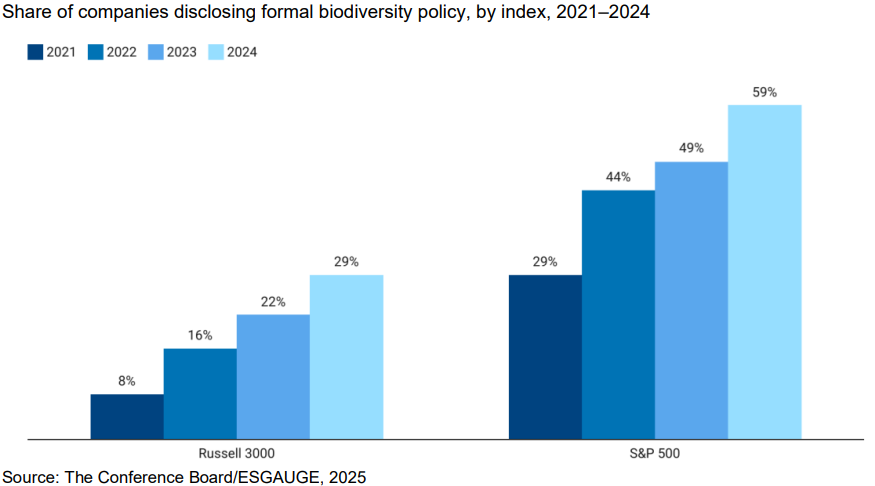

Biodiversity—the variety of ecosystems, species, and genes—underpins the natural systems that sustain food, water, climate, and economic stability. In 2025, corporate engagement with biodiversity is gaining traction, driven by new regulations, investor expectations, and increased exposure to nature-related risks. Frameworks like the Taskforce on Nature-Related Financial Disclosures are further prompting companies—particularly in agriculture, extractives, and food and beverage—to assess and disclose their reliance on natural ecosystems.

While more companies are integrating nature-related risks into sustainability and enterprise strategies, progress is uneven. Biodiversity impacts are highly location specific and difficult to measure consistently, complicating target setting and disclosure. Implementation is especially challenging for firms with complex supply chains, limited site-level data, or operations in ecologically sensitive areas. As efforts mature, many companies are sharpening focus on core issues such as reforestation, regenerative agriculture, and land restoration—supported by investments in traceability, geospatial data, and local partnerships. Sector-specific challenges are also surfacing: for example, food and agriculture firms may address pollinator decline and soil health, while extractives and infrastructure companies face scrutiny over land use and habitat disruption.

Looking ahead, companies in high-exposure sectors should prepare for further pressure to align with global frameworks like the Global Biodiversity Framework, expand nature-related disclosures, and embed biodiversity metrics into broader ESG and risk reporting systems.

Priority 6: Water Stewardship

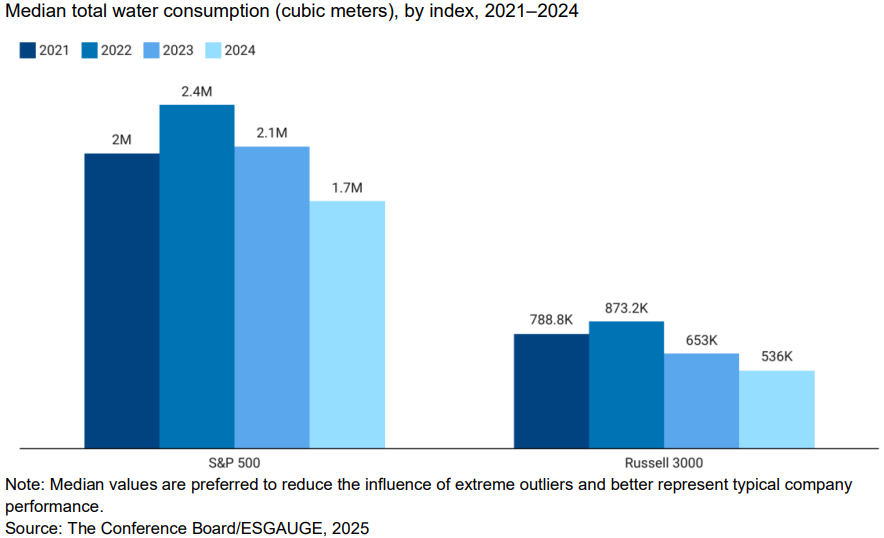

Corporate water consumption has been decreasing since a peak in 2022

Water stewardship is emerging as a key sustainability priority in 2025, especially for companies with operations or supply chains in water-stressed regions. Prolonged drought in areas like the US Southwest, Texas, and the Colorado River Basin has intensified both physical and regulatory risks. Water-intensive sectors—such as agriculture, food and beverage, data centers, and manufacturing—face growing pressure to increase transparency, manage local risks, and demonstrate measurable progress. Reflecting this urgency, US CEOs ranked water as their second-highest environmental priority at the start of the year.

For companies that identify water as a material issue, strategies are shifting from broad efficiency efforts to more localized, risk-based approaches. These include watershed-level assessments, science-based water targets, and investments in advanced recycling and irrigation technologies. Collaborating with local stakeholders to manage shared resources will be essential to ensuring long-term operational continuity. Recent disclosure data show steady progress: median water consumption among S&P 500 and Russell 3000 companies has declined consistently since 2022, which may signal growing momentum toward more strategic and accountable water management.

Priority 5: Supply Chain Transparency

Most polled companies have increased their focus on human rights in the supply chain in 2025

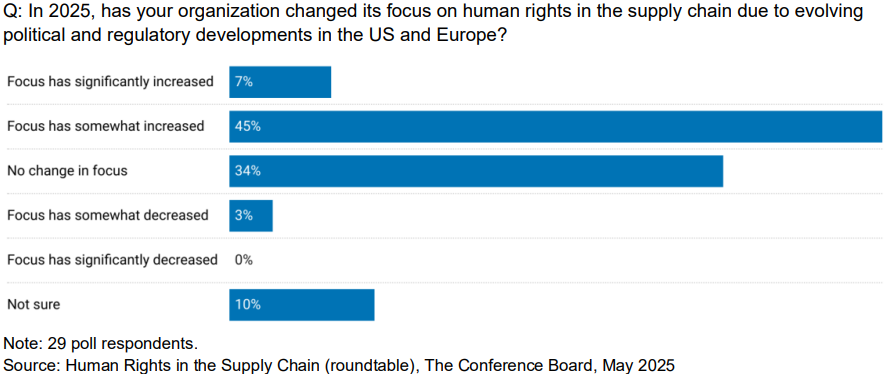

Supply chain sustainability is becoming a top priority for sustainability leaders, in recognition that most environmental and social impacts—such as scope 3 emissions, deforestation, and human rights issues—occur upstream. Regulatory pressure, investor scrutiny, and reputational risk are converging, driving companies to increase accountability and transparency across supply chain tiers. Emerging regulations are accelerating this shift.

The EU Corporate Sustainability Due Diligence Directive and Regulation on Deforestation-Free Products will require many companies— including large US-based multinationals—to identify, prevent, and address environmental and human rights risks across their global operations and value chains. In the US, the Uyghur Forced Labor Prevention Act blocks imports from China’s Xinjiang region unless companies can prove the absence of forced labor. While geographically targeted, the compliance demands— such as end-to-end traceability, third-party verification, and supplier due diligence—signal a broader, more rigorous approach to supply chain sustainability.

Supply chain sustainability challenges remain significant. Sustainability teams often lack visibility into lower-tier suppliers, contend with fragmented data systems, and face inconsistent vendor reporting—especially in high-risk or emerging markets. Scope 3 emissions measurement is complex but increasingly vital for credible climate strategies. Meanwhile, geopolitical shifts, tariffs, and trade restrictions are reshaping sourcing decisions. Still, corporate momentum is building: over half of firms surveyed by The Conference Board in May 2025 reported greater focus on human rights in the supply chain.

Priority 4: Climate Strategy

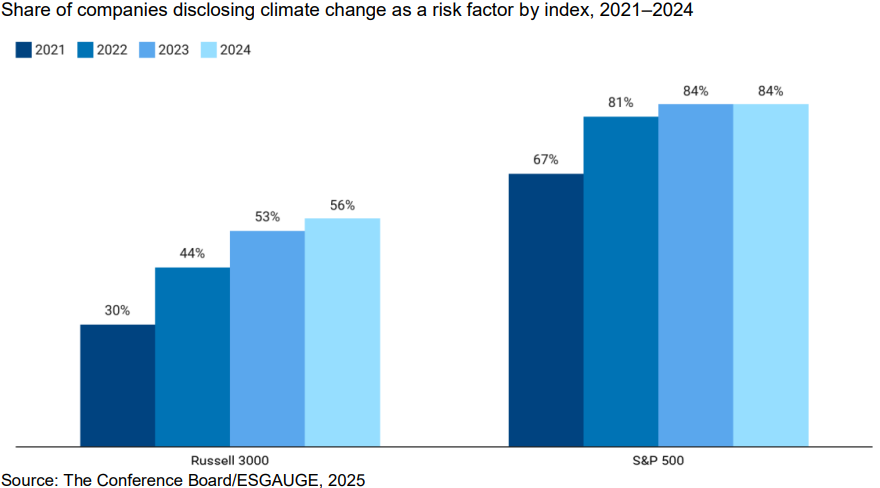

More US public companies are disclosing climate change as a risk factor

Climate remains a top corporate sustainability priority in 2025, as companies navigate physical risks (extreme weather, drought, flooding), transition risks (policy shifts, evolving disclosure requirements), and reputational risks linked to perceived inaction. Notably, US CEOs ranked climate resilience as their top environmental priority at the start of 2025.

As of 2024, over 80% of S&P 500 and half of Russell 3000 companies publicly identify climate change as a business risk, though fewer classify it as financially material. Most S&P 500 companies—and an increasing share of those on the broader Russell 3000—also now report scope 1 (direct) and scope 2 (purchased energy) emissions, with scope 3 (value chain) disclosure gaining traction. This reflects a broader shift toward more comprehensive, data driven emissions management and increased stakeholder calls for transparency.

At the same time, the policy environment is evolving. At the federal level, US climate policy has shifted toward expanding fossil fuel development and scaling back certain clean energy incentives. However, regulatory momentum continues at the state level—most notably in California, where binding climate disclosure laws for large public and private companies will maintain pressure on corporate climate reporting and governance.

With 2030 target deadlines approaching, companies should further integrate climate considerations into core decision-making processes. This includes embedding physical and transition risk assessments into enterprise risk management, aligning capital allocation with decarbonization goals, and strengthening climate oversight at the board and executive levels.

Priority 3: ROI

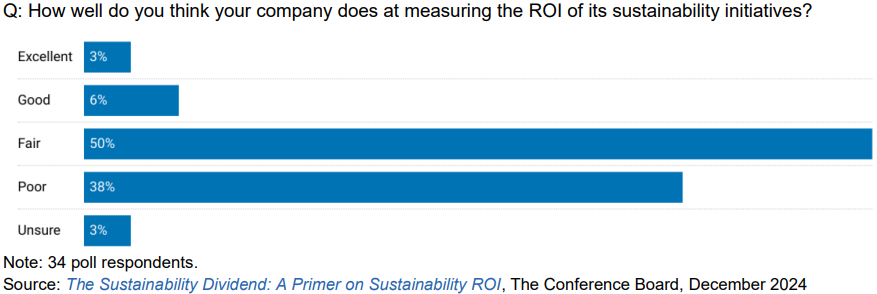

Only 9% of polled executives think they are doing a good or excellent job at measuring the ROI of sustainability

As sustainability becomes more integrated into core business functions, demonstrating the business ROI of sustainability investments and initiatives is increasingly important. Boards and C-Suite executives expect credible evidence that sustainability drives operational efficiency, mitigates risk, ensures regulatory readiness, and contributes to long-term value. This has only grown more urgent in 2025 amid inflation, supply chain disruption, and geopolitical uncertainty.

Most sustainability teams are still early in this process. In 2024, just 9% of surveyed executives rated their ability to measure sustainability ROI as good or excellent, while 38% said it was poor. These results reflect complex practical challenges such as quantifying intangible benefits, integrating sustainability into financial systems, and aligning accountability across functions.

To build credibility, many teams are starting with direct, measurable returns, including cost savings from energy efficiency, water conservation, and waste reduction initiatives. Demonstrating such returns can help justify ongoing investment and create a foundation for broader measurement efforts. From there, frameworks can expand to capture the indirect and longer-term value of sustainability initiatives, including enhanced brand equity, stronger employee engagement, and improved supply chain resilience. Sustained progress ultimately relies on strong internal collaboration—particularly among the sustainability, finance, procurement, HR, operations, and strategy teams—to ensure consistent measurement, shared accountability, and lasting impact.

Priority 2: ESG Reporting

Regulations ESG reporting regulations continue to evolve, with key EU directives being simplified, though the overall shift toward mandatory disclosure remains clear

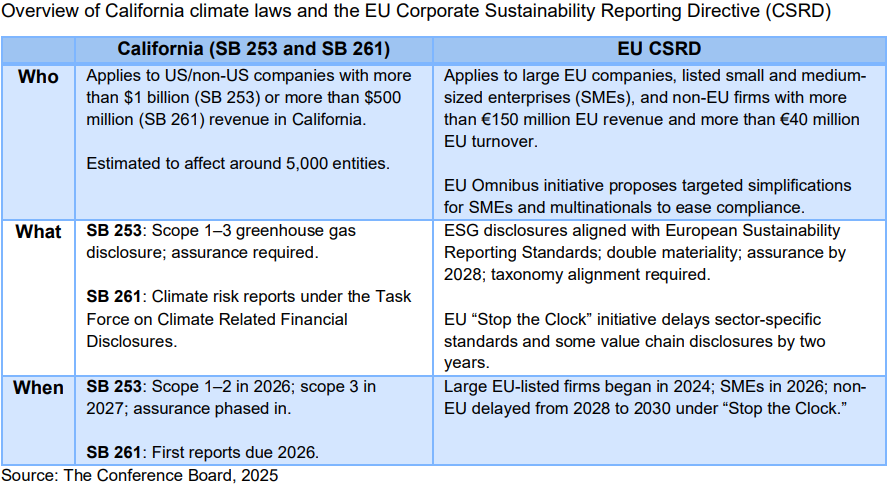

In recent years, there has been a shift from voluntary corporate sustainability reporting frameworks to mandatory, jurisdiction-specific disclosure requirements. Top of mind for many companies are emerging US climate disclosure laws—at both federal and state levels—and Europe’s expansive CSRD, which has significant extraterritorial implications.

The landscape has evolved and become more complex in 2025, and what once seemed a linear path toward mandatory international disclosure is now increasingly fragmented. In the US, the Securities and Exchange Commission (SEC) has effectively withdrawn its federal climate disclosure rule under the new administration, while key states—most notably California with its SB 253 and SB 261 laws—are advancing their own robust mandates. In the EU, the CSRD remains in effect but is undergoing revision and streamlining through the ongoing Omnibus initiative, delaying applicability for non-EU companies and easing compliance for SMEs and multinationals. This evolving patchwork has complicated planning for sustainability teams, even as the broader shift toward mandatory disclosure continues for large companies and global firms.

This divergence presents strategic choices. Some companies are opting for a minimum compliance approach to limit legal exposure—especially in politically volatile markets. Others are aligning with the highest global standards to bolster investor confidence and future-proof their reporting, despite higher near-term costs. Regardless of approach, ESG data will increasingly need to meet financial-grade standards, supported by early audit committee involvement and stronger internal controls to enable assurance.

Priority 1: Policy Shifts

Sustainability leaders are adjusting to US policy shifts by refining language, strengthening legal review, and emphasizing ROI

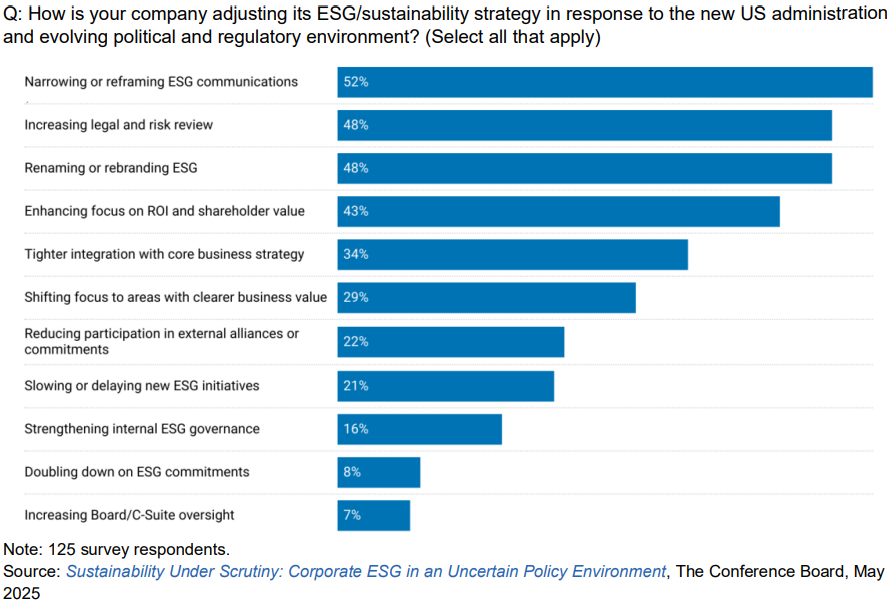

Navigating ESG policy shifts has become the top corporate sustainability priority in the second half of 2025. Recent changes in US federal climate, energy, and disclosure policy—including the suspension of the SEC climate disclosure rule and a pullback from international engagement—have disrupted core policy signals, reshaped stakeholder expectations, and added new layers of complexity.

According to recent research from The Conference Board, 80% of sustainability executives have adjusted their strategies in response to the evolving US policy landscape. Common actions include strengthening legal and risk oversight, refining public messaging—substituting charged terms like “ESG” with “sustainability” or “resilience”—and placing greater emphasis on demonstrating the ROI of sustainability investments. In this environment, materiality, defensibility, and alignment with enterprise value have become guiding principles.

However, these developments reflect a recalibration—not a retreat—from corporate sustainability. While federal policy has shifted, investors, customers, employees, and global regulatory and market trends continue to shape expectations and corporate actions. Looking ahead, the most effective sustainability strategies will be rooted in business fundamentals; adapted to changing political dynamics; and anchored in credible, measurable execution.

This article is based on corporate disclosure data from The Conference Board Benchmarking platform, powered by ESGAUGE.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release