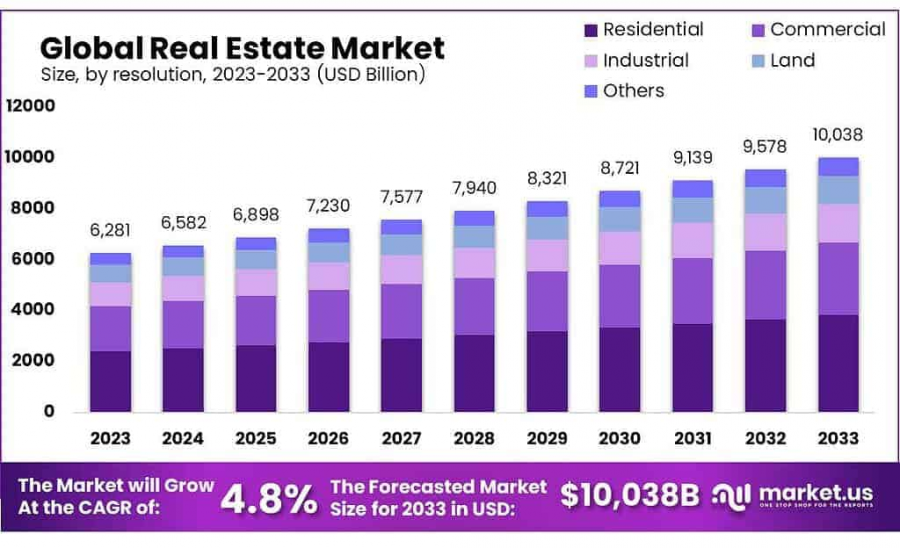

Real Estate Market Size to Reach USD 10038 Billion by 2033 | Growing at a CAGR of 4.8%

Real Estate Market size is expected to be worth around USD 10038 Billion by 2033, from USD 6281 Billion in 2023, growing at a CAGR of 4.8% from 2023 to 2033.

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The global Real Estate Market is a cornerstone of economic development, encompassing residential, commercial, industrial, and retail sectors. As a vital industry that contributes significantly to GDP and employment, real estate has witnessed continuous evolution driven by urbanization, population growth, and technological advancements. The market is influenced by macroeconomic factors, government policies, foreign investments, and shifting consumer preferences, shaping its expansion and volatility across different regions. The emergence of sustainable and smart infrastructure, along with digital transformation in property management and transactions, is redefining market dynamics, and making real estate more accessible and efficient.

The commercial segment, including office spaces and retail centers, has transformed due to changing work models and the rise of e-commerce, leading to demand fluctuations in office spaces and an increased focus on flexible workspaces. Meanwhile, the industrial real estate sector has gained momentum due to surging e-commerce activities, necessitating expansive warehousing and logistics facilities to support last-mile deliveries. Emerging economies, particularly in Asia-Pacific and Latin America, have become attractive destinations for real estate investments, supported by improving regulatory frameworks, infrastructure projects, and growing investor confidence.

Several key driving factors contribute to the growth of the global real estate market. Rising disposable incomes, favorable lending conditions, and expanding corporate activities fuel demand across residential and commercial segments. Technological advancements, including AI-driven property management, virtual property tours, and blockchain-based transactions, have streamlined the buying, selling, and leasing processes, enhancing market transparency and efficiency.

The increasing adoption of sustainable and green building practices, driven by stringent regulations and environmental consciousness, is also reshaping market trends, encouraging developers to invest in energy-efficient and smart buildings. Additionally, the inflow of foreign direct investment (FDI) and real estate investment trusts (REITs) has strengthened the financial landscape of the industry, providing liquidity and enhancing market participation from institutional and retail investors.

Future growth opportunities in the global real estate market are poised to be shaped by technological integration, demographic shifts, and emerging investment avenues. The expansion of smart cities and the integration of IoT, AI, and big data analytics in property management will enhance efficiency and decision-making processes, creating a more responsive and data-driven real estate sector. The rising focus on mixed-use developments that combine residential, commercial, and recreational spaces within integrated communities will drive new investments, catering to evolving urban lifestyles.

Additionally, the growing demand for sustainable infrastructure and net-zero carbon buildings will accelerate investments in eco-friendly developments, aligning with global sustainability goals. The increasing trend of co-living and co-working spaces, particularly in urban hubs, will redefine traditional property utilization, offering flexible and cost-effective solutions for individuals and businesses. Furthermore, emerging economies are expected to witness a surge in real estate activities due to rapid industrialization, infrastructural enhancements, and favorable policy frameworks, making them attractive investment hubs.

Despite potential challenges such as economic downturns, geopolitical uncertainties, and regulatory complexities, the global real estate market remains resilient, adapting to evolving consumer behaviors and technological disruptions. As investors and developers continue to explore innovative solutions, the industry is set to witness sustained growth, marked by digital transformation, sustainability initiatives, and strategic investments across key geographies. The coming years will be pivotal in shaping a more dynamic, technology-driven, and sustainable real estate ecosystem, reinforcing its critical role in global economic development.

👉 𝐌𝐚𝐤𝐞 𝐜𝐨𝐧𝐟𝐢𝐝𝐞𝐧𝐭 𝐝𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬 𝐮𝐬𝐢𝐧𝐠 𝐨𝐮𝐫 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐚𝐧𝐝 𝐚𝐧𝐚𝐥𝐲𝐬𝐢𝐬. 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭@ https://market.us/report/real-estate-market/free-sample/

Key Takeaways

• Market Size: Real Estate Market is projected to reach USD 10038 billion by 2033, growing at 4.8% CAGR from USD 6281 billion in 2023.

• Segment Dominance: The residential segment captured over 38.3% market share in 2024, indicating strong demand for housing properties.

• Property Preferences: Fully furnished properties held 41.6% market share in 2024, followed by semi-furnished and unfurnished options.

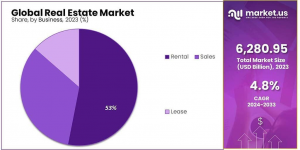

• Business Segment Significance: Rental properties accounted for over 54.5% market share in 2024, reflecting demand for flexible accommodation.

• Mode Analysis: Offline transactions dominated with 76.3% market share in 2024, although online transactions are expected to grow rapidly.

• Latest Trends: Global urbanization and technological integration drive market growth, particularly in the Asia Pacific region, which captured 53% market share in 2024.

• Home prices are expected to rise by around 5.4% in 2023, according to Fannie Mae’s housing forecast.

The median rent in the United States was $1,717 in February 2023, an increase of 6.7%.

Real Estate Top Trends

1. Climate Change Impact: Properties in areas prone to natural disasters are experiencing slower value growth. For instance, homes in flood zones and wildfire regions are appreciating at a reduced rate compared to safer properties. This trend is leading to potential "disaster discounts" in the market.

2. Luxury Market Expansion: Cities like Sydney are becoming prime destinations for luxury shopping, attracting top global brands. This influx is driven by the city's financial prominence, iconic landmarks, and high spending power, indicating a robust luxury real estate market.

3. Melbourne's Property Opportunities: Despite a slight decline in 2024, Melbourne's property market presents significant opportunities for long-term investors. Factors such as interstate migration, increased mortgage volumes, and housing supply dynamics are contributing to a favorable investment environment.

4. REITs Recovery: Real Estate Investment Trusts (REITs) are rebounding after a period of underperformance. Valuations are becoming more attractive, and with potential declines in long-term bond yields, REITs are offering substantial dividend yields, making them appealing to investors.

5. Government Property Reduction: Initiatives to reduce federal government real estate holdings are influencing urban markets. Selling and repurposing obsolete federal buildings can lead to increased office-to-residential conversions, potentially boosting real estate values in central business districts.

Key Market Segments

By Property Type Analysis

In 2024, the Residential Segment dominated the real estate market, capturing more than 38.3% of the total market share. This segment encompasses properties such as single-family homes, apartments, and condominiums, catering to individuals and families seeking residential spaces. The Commercial Segment also represented a significant portion of the market, including office buildings, retail spaces, and hotels. This sector attracts businesses and investors looking for profitable opportunities related to commercial operations and rental income. Industrial Properties, including warehouses, manufacturing facilities, and distribution centers, gained prominence in 2024 due to the surge in demand from the logistics and e-commerce sectors. Key logistics hubs became focal points for industrial real estate, driving substantial demand for these properties.

Land Properties, including undeveloped and agricultural land, also held a notable market share. Investors and developers alike sought land for various purposes such as development, agriculture, and investment, further contributing to the diversity of the real estate market. The Other Types of Real Estate category includes niche properties like healthcare facilities, educational institutions, and recreational properties. Although a smaller portion of the market, these specialized properties offer unique investment opportunities in their respective sectors.

By Property Type Overview

In 2024, Fully Furnished Properties held the largest market share, capturing more than 41.6% of the market. These properties offer tenants or buyers the convenience of being equipped with furniture, appliances, and amenities, providing an immediate move-in experience. Semi-Furnished Properties represented a significant share, offering a balance between furnished and unfurnished options. These properties typically include essential fixtures and appliances, allowing tenants to personalize the space according to their preferences. Unfurnished Properties continued to hold importance, though they represent a smaller share of the market. These properties provide tenants or buyers with a blank slate to furnish and decorate as desired, offering flexibility and cost savings in the long term.

By Business Analysis

The Rental Segment held a dominant position in the market in 2024, commanding more than 54.5% of the market share. This segment is characterized by the temporary use of properties in exchange for periodic payments, catering to individuals and businesses looking for flexible, short-term accommodations. Sales of Real Estate Properties also represented a significant share, involving transactions where ownership is transferred from sellers to buyers. This segment includes residential homes, commercial properties, and land, involving long-term ownership changes and investments. Leasing (Long-term Rentals) also remained an essential segment, providing tenants with the option to occupy properties for extended periods under contractual agreements. This option is particularly appealing to businesses and individuals seeking stability and predictability.

By Mode of Transaction Analysis

In 2024, Offline Transactions held a significant share in the real estate market, accounting for more than 76.3% of total transactions. This mode of transaction is characterized by traditional, face-to-face interactions, involving physical offices, agents, and property viewings, catering to those who prefer personalized service and in-person communication. Online Real Estate Transactions, although representing a smaller portion of the market, are gaining momentum. Digital platforms, websites, and apps enable users to search for properties, communicate with agents, and complete transactions remotely, offering convenience and accessibility for tech-savvy users.

👉 To Get Moment Access, Buy Report Here: Score Up to 30% Off! https://market.us/purchase-report/?report_id=103740

Key Market Segments List

Based on Property

• Residential

• Commercial

• Industrial

• Land

• Other Properties

By Property Type

• Fully Furnished

• Semi Furnished

• Unfurnished

Based on Business

• Sales

• Rental

• Lease

Based on Mode

• Online

• Offline

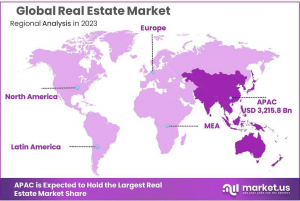

Regional Analysis

The Asia Pacific Region emerged as a key player in the global real estate market, capturing 53% of the total market share. This dominance is primarily driven by rapid urbanization, population growth, and large-scale infrastructure development across the region.

Countries such as China and India have been pivotal in shaping the Asia-Pacific market's growth. Both nations' booming economies and extensive urbanization projects have fueled the demand for residential, commercial, and industrial properties, driving robust investment and development activities in the region.

Regulations On the Real Estate Market

1. Real Estate (Regulation and Development) Act, 2016 (RERA): This act mandates that all real estate projects and agents register with the Real Estate Regulatory Authority (RERA) in each state. It aims to protect homebuyers by ensuring timely project delivery, quality construction, and transparency in transactions. Developers must provide detailed project information, including timelines and financial disclosures.

2. Transfer of Property Act, 1882: This act outlines the legal framework for the transfer of property in India. It covers various modes of transfer, such as sale, mortgage, lease, and gift, and specifies the rights and duties of parties involved in property transactions. The act ensures that property transfers are conducted legally and fairly.

3. Registration Act, 1908: This act requires the registration of certain documents related to property transactions, including sale deeds, mortgages, and leases exceeding one year. Registration provides public notice of property transactions, helping to prevent fraud and disputes over property ownership.

4. Indian Contract Act, 1872: This act governs contracts in India, including those related to property transactions. It defines the conditions under which contracts are valid and enforceable, ensuring that agreements related to property sales, leases, and mortgages are legally binding.

5. Indian Stamp Act, 1899: This act imposes a duty on the transfer of property through instruments like sale deeds, gift deeds, and mortgages. The stamp duty varies by state and is essential for the legal recognition of property documents. Proper payment of stamp duty is crucial for the validity of property transactions.

Key Players

• Brookfield Asset Management Inc.

• CBRE Global Investors

• CBRE Group, Inc.

• Colliers International Group Inc.

• Cushman & Wakefield

• Digital Realty Trust, Inc.

• Equity Residential

• Hines

• Host Hotels & Resorts, Inc.

• Jones Lang LaSalle (JLL)

• Knight Frank LLP

• Lendlease Corporation Limited

• Mitsui Fudosan Co., Ltd.

• Newmark Group, Inc.

• Prologis, Inc.

• Savills plc

• Simon Property Group, Inc.

• The Blackstone Group Inc.

• Unibail-Rodamco-Westfield SE

• Vornado Realty Trust

Conclusion

The Real Estate Market continues to evolve, driven by urbanization, economic growth, and changing consumer preferences. The demand for residential, commercial, and industrial spaces remains strong, with buyers and investors looking for quality developments and sustainable infrastructure. While challenges like affordability, regulatory changes, and market fluctuations exist, the sector shows resilience and long-term potential. Innovation in smart homes, green buildings, and technology-driven real estate solutions will shape the future of the industry. Overall, real estate remains a key investment avenue, offering opportunities for growth and stability in the years ahead.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Building & Construction Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release